where can i get a copy of my tax exempt certificate

Write an application to get a copy of tax exemption certificate. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

Illinois Tax Exempt Certificate Five Mile House

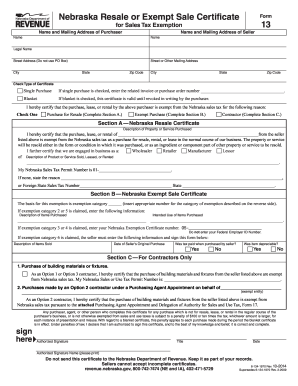

July 15 2019 Due to recent legislative changes the Department of Revenue DOR has updated the Resale Certificate.

. The Section also provides records information by telephone and email and provides plain and certified copies upon request. To document tax-exempt purchases of such items retailers must keep in their books and records a certificate of resale. Updated Exemption Certificates.

How can I get a copy of an organizations exemption application or annual information return from the IRS. Purchasers Affidavit of Export Form. If so an organization may generally contact Customer.

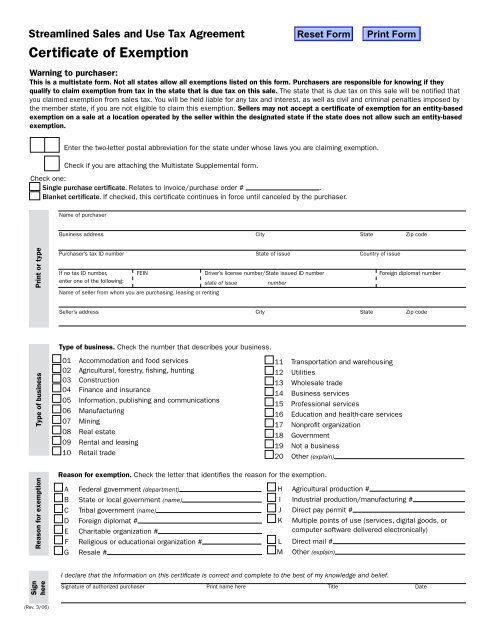

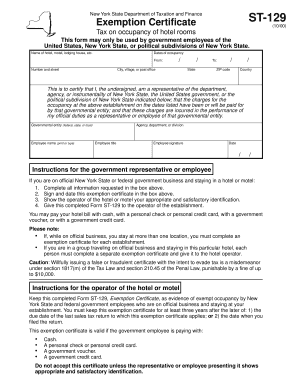

A tax exempt organization may need a letter to confirm its tax-exempt status or to reflect a change in its name or address. You may use the electronic certificate S-211E to claim an exemption from Wisconsin state county baseball stadium local exposition and premier resort sales or use taxes. 48 rows Sales Tax Exemption Certificates.

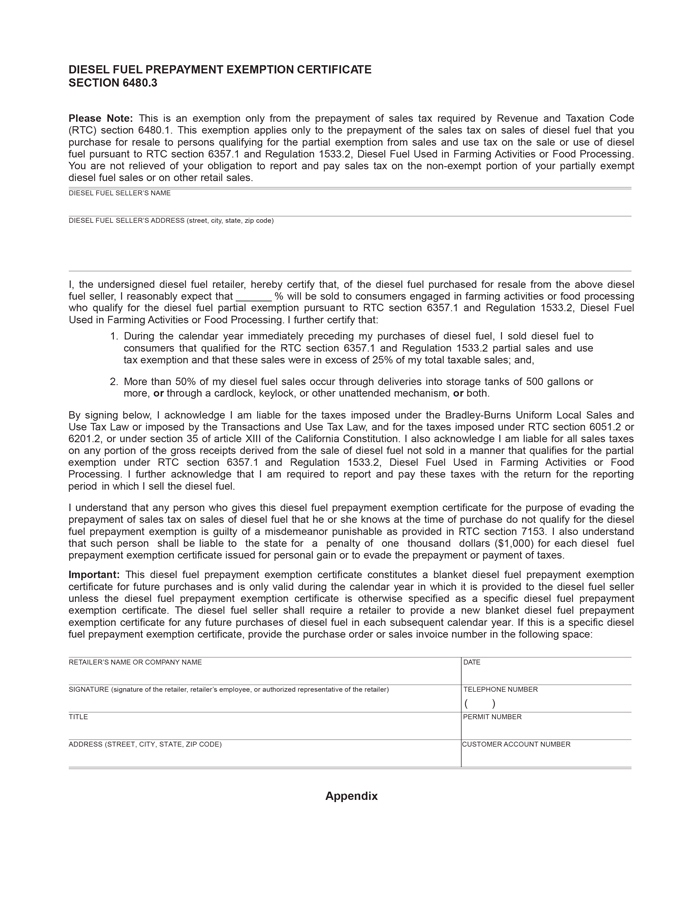

There are a number of exemptions and exceptions from the requirement to collect and remit sales tax. This verification does not relieve the vendor of the. Streamlined Sales and Use Tax Certificate of Exemption Form.

Enter the account number from the resale certificate in the Purchasers Louisiana Account Number box. To request a copy of either the exemption application including all supporting. Any individual or entity meeting the definition of a dealer in OC.

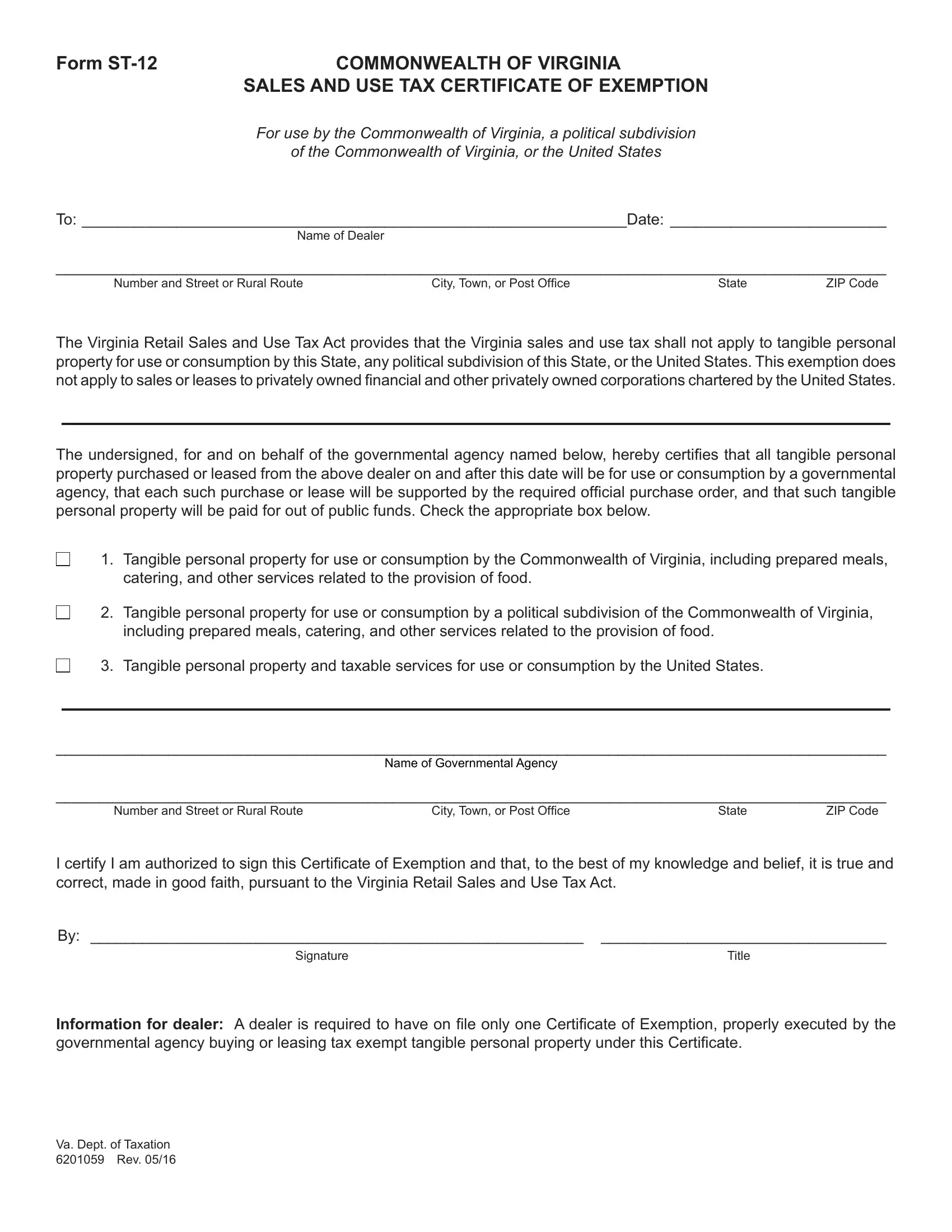

How to use sales tax exemption certificates in Maryland. Most of the entity-based exemptions require a special exemption. Sales and use tax certificates can be verified using the Tennessee Taxpayer Access Point TNTAP under Information and Inquiries.

Uniform Sales Use Tax Certificate -. Enter the purchasers legal name in the Purchasers Business Name box. In most states the sales tax is designed to be paid.

To otherwise request a copy of the original determination letter submit Form 4506-B Request for a Copy of Exempt Organization IRS Application or Letter PDF using email feature on form. 48-8-2 is required to register for a sales and use tax number regardless of whether all sales will be online out of. You can print a copy of your Certificate of Registration or License using MyTax IllinoisFrom your MyTax Account the Certificate of Registration or License is located by selecting View more.

Although the Section continues to accept. How can I get a copy of Form 1023. You may get an application form from the official website or the nearest office of the Internal Revenue Service.

Purchasers may either document their tax-exempt purchases by. Form 1023 must be submitted electronically on Paygov where you can also preview a copy of the form.

How To Get A Sales Tax Certificate Of Exemption In Virginia Startingyourbusiness Com

U S State Sales Tax Atera Support

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Free 10 Sample Tax Exemption Forms In Pdf

California Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Virginia Sales Tax Exemption Form Fill Out Printable Pdf Forms Online

Form 13 Nebraska Fill Out And Sign Printable Pdf Template Signnow

Streamlined Sales Tax Certificate Of Exemption State Of Iowa

Tax Exempt Certificate Fill Online Printable Fillable Blank Pdffiller

Tax Clearance Certificates Department Of Taxation

Free 10 Sample Tax Exemption Forms In Pdf

Woocommerce Tax Exempt Customer Role Exemption Plugin

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

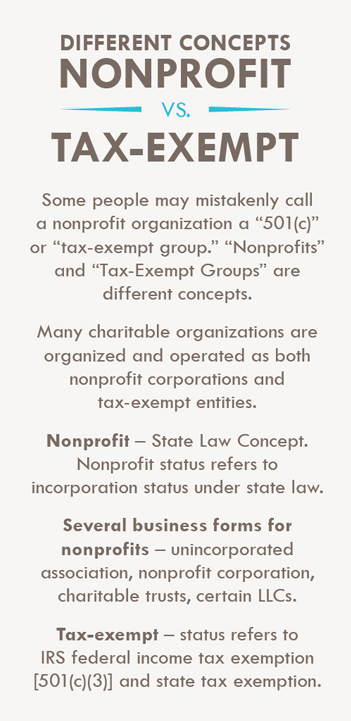

What Is The Difference Between Nonprofit And Tax Exempt

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

Kentucky Sales Tax Exemption Certificate Fill Out Sign Online Dochub

Learn How To Request An Exemption Certificate At Mytax Dc Gov Mytax Dc Gov